Billing vs Invoicing: What's the Difference?

Business and corporate finance can be a minefield of terminology and jargon. And even two of the most straightforward terms might not be obvious to understand – 'billing' and 'invoicing'.

Often used interchangeably, these terms hold distinct meanings and functions critical to your company's financial health.

This guide will demystify these concepts, offering a deep dive into their roles, differences, and the substantial impact they can have on your business operations.

Defining the Basics

When navigating the financial aspects of a business, it's crucial to understand specific terms.

'Billing' and 'invoicing' are among the most used, and you'll likely hear them daily. Although they seem similar, they serve distinct purposes.

What is Billing?

Billing is the process of generating a bill to account for a transaction. It's the method businesses use to request payment for goods or services provided.

Examples of Billing Scenarios

- Monthly subscription fees billed to customers

- Utility companies bill for usage

- Professional services, like consultants, bill for hours worked

What is Invoicing?

Invoicing, however, involves creating an invoice, a detailed list of goods or services provided, along with the amounts due. It's a formal payment request, often with a specified payment deadline.

Examples of Invoicing Situations

- A freelance designer sends an invoice after completing a project

- A supplier issues an invoice for delivered goods

- Post-completion of a service, a company sends an invoice detailing the work done.

Each element is critical in business transactions, ensuring clarity and efficiency in financial dealings. Understanding the nuances can help you navigate these processes with greater confidence.

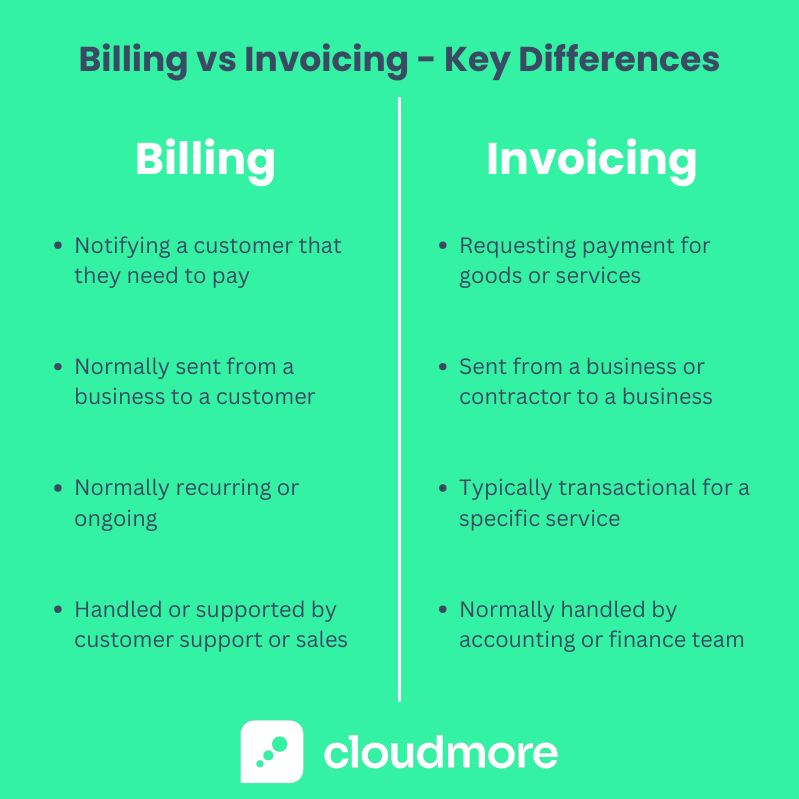

Key Differences Between Billing and Invoicing

Understanding the key differences between billing and invoicing is essential for effective financial management. While they intersect, they have distinct roles in the accounting process.

Billing vs. Invoicing – The Core Differences

- Purpose: Billing is about notifying customers of the need for payment. Invoicing, however, details the specifics of a transaction, providing a breakdown of services or products provided.

- Recipient: Billing is often directed towards individuals or B2C scenarios. Invoicing is more common in B2B transactions, where detailed records are crucial.

- Timing: Billing is typically a recurring process in subscription models or ongoing services. Invoicing is transactional, usually issued after the completion of a service or delivery of goods.

- Data Transformation: Billing data often transforms into invoicing data. The initial billing information serves as a base for creating a detailed invoice.

- Who Works With Each?: Billing is usually managed by customer service or sales departments. Invoicing is typically handled by the accounting or finance department, ensuring accuracy in financial records.

Invoice vs Bill – Understanding the Terms

The terms' invoice' and 'bill' are sometimes used interchangeably but have unique contexts. A bill is more immediate, implying a need for a quick payment. An invoice, while similar, is often more detailed and used in business-to-business transactions. Understanding these nuances helps in selecting the correct term for your financial documents.

Practical Examples

To fully grasp the concepts of billing and invoicing, it's helpful to look at practical examples. These processes, fundamental in business operations, vary in their application but serve a common goal: ensuring accurate and timely financial transactions.

Examples of Bills and Billing Processes

Standard Billing Process:

- Service or Product Delivery: The process begins once a product is delivered or a service is provided.

- Billing Information Compilation: Essential details like customer name, amount due, and service date are gathered.

- Bill Generation: A bill is created, usually monthly, detailing the amount owed.

- Bill Issuance: The bill is sent to the customer, either electronically or via traditional mail.

- Payment Reminder and Collection: Follow-ups are sent as reminders until payment is received.

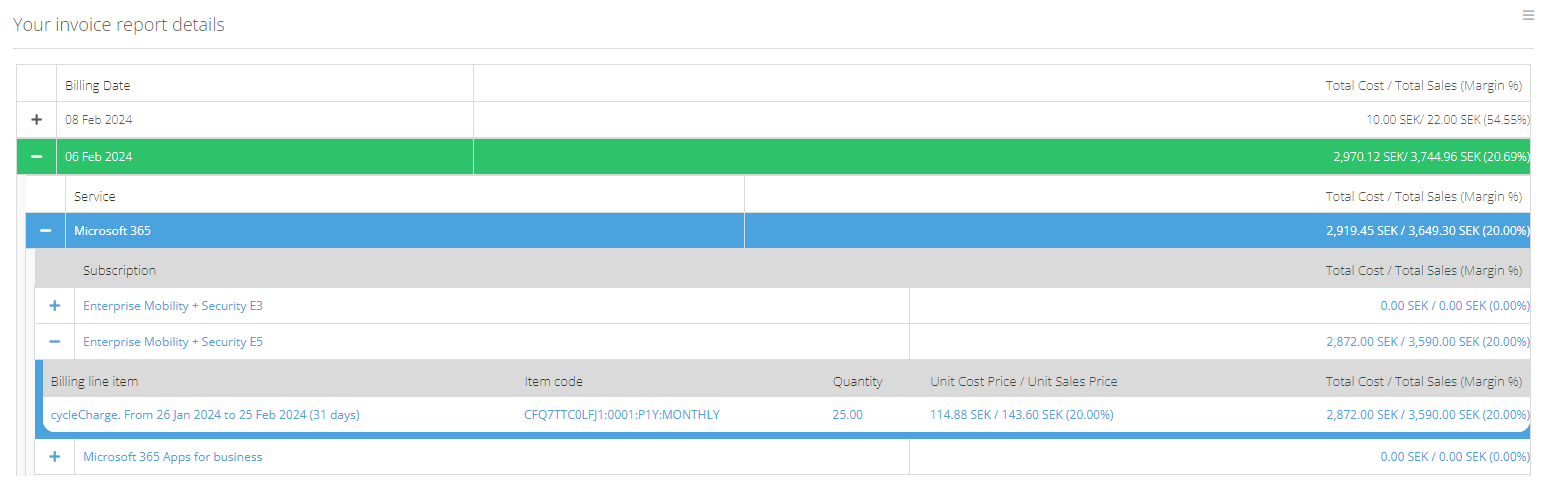

Below is a look at how billing appears in Cloudmore's platform:

Examples of Invoices and Invoicing Processes

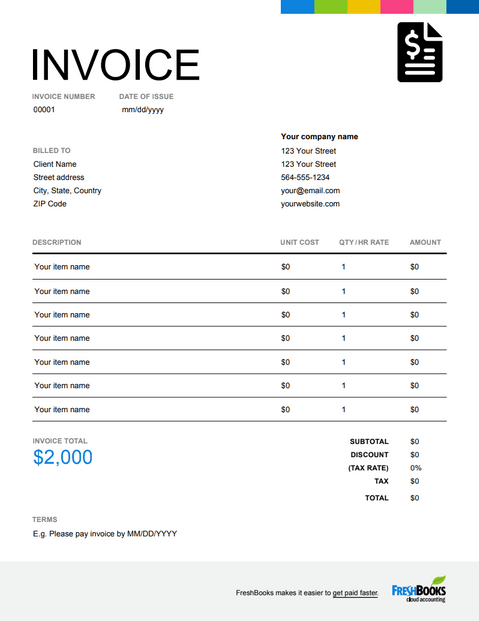

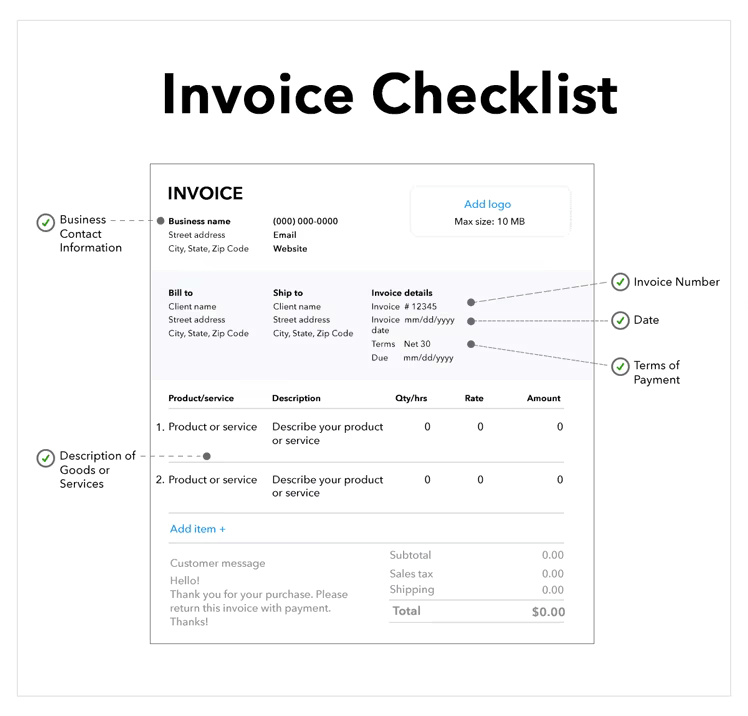

Here's what a basic invoice typically looks like:

Standard Invoicing Process:

- Completion of Service or Product Delivery: The trigger for invoicing is completing a service or delivering goods.

- Invoice Creation: An invoice is generated detailing services or products, quantities, prices, and the total amount due.

- Invoice Approval: The invoice is reviewed and approved internally.

- Invoice Issuance: The approved invoice is sent to the client or customer.

- Payment Tracking and Follow-up: Payments are tracked, and reminders are sent as needed.

Bills vs. Invoices in Different Industries

- Retail Sector: Primarily uses bills for immediate transactions

- Consulting Services: Often use invoicing for project-based or hourly services

- Subscription-Based Services: Utilize recurring billing for ongoing services

- Construction Industry: Employs a combination of progress invoicing and final billing

- Healthcare Sector: Uses billing for patient services, often involving insurance claims

Each industry adapts these financial documents to fit their specific operational needs and customer interactions.

Modern Practices

In the dynamic world of finance, modern practices are shaping the future of billing and invoicing. Embracing digital transformation is vital for businesses looking to streamline their financial processes.

Digital Transformation: E-Billing and Online Invoicing

Technology has revolutionized the way businesses handle financial transactions. E-billing and online invoicing are at the forefront of this change. With e-billing, companies can send bills electronically, reducing paper usage and speeding up payments. On the other hand, online invoicing allows for creating, sending, and managing invoices over the internet. This digital shift enhances efficiency and offers improved tracking and better record-keeping.

Different Types of Invoicing and Billing Systems

Various systems cater to different business needs:

- Subscription Management Systems: Ideal for businesses with recurring billing models

- Time-Based Billing Systems: Used by service providers who charge based on time spent

- Project-Based Invoicing Systems: Suitable for businesses billing per project completion

- Flat-Rate Billing Systems: Where a fixed price is set for services or products

Choosing the right system depends on your business model and customer base.

Invoicing and Payment Automation

The future of billing and invoicing lies in automation. Automated systems can generate invoices, send reminders, and even process payments, reducing manual errors and saving time. This shift streamlines operations and provides real-time financial insights, aiding in better decision-making.

Key Takeaways on Billing vs Invoicing

As we conclude our exploration of billing vs invoicing, it's clear that understanding these concepts is vital for efficient financial management. Let's recap their main differences and the impact they have on businesses:

- Billing is typically a recurring request for payment, often seen in B2C interactions

- Invoicing is more detailed, used in B2B transactions, and is issued after the completion of a service or delivery of goods.

- The timing and recipient of these documents differ, reflecting their unique roles in business transactions.

- Embracing modern digital practices like e-billing and online invoicing can enhance efficiency and accuracy.

- Different industries adapt billing and invoicing methods to suit their specific operational needs.

Adopting best practices in billing and invoicing streamlines your financial processes and ensures clarity and professionalism in your transactions. Stay ahead by integrating these insights into your business's financial strategies.

Share this

You May Also Like

These Related Stories

Digital Commerce and AI: Disrupting Traditional B2B Supply Chains

Contracts vs Subscriptions in the B2B World