What is Enterprise Billing? – Full Guide, Best Software, Examples

Are you ready to embark on a journey?

We're about to explore the financial superhighway that powers the engines of large businesses – enterprise billing.

It may sound like a labyrinthine term, but it's the financial heartbeat of colossal organizations.

In this can't-miss guide, we're diving into Enterprise Billing – a roadmap that will empower you with the knowledge and confidence to navigate the complexities of enterprise billing like a pro.

Defining Enterprise Billing

Now, let's kick things off by unraveling the first layer of enterprise billing. What exactly is it, you ask?

Well, at its core, enterprise billing is like the financial maestro of a large business orchestra. It orchestrates a complex symphony of transactions, seamlessly conducting the flow of money in and out of an organization. Think of it as the maestro that ensures every note of your financial score is flawless.

But let's not stop at the surface. Enterprise billing isn't just about sending invoices; it's about automating, streamlining, and optimizing financial processes on an industrial scale.

It's the invisible hand that guides invoices, payments, subscriptions, and financial analytics, ensuring they dance in harmony to the sweet sound of financial success.

The Importance of Enterprise Billing

We've scratched the surface, but you might wonder, "Why should I care about this financial wizardry?"

Well, enterprise billing isn't just a mundane necessity; it's the lifeblood of large organizations.

Imagine for a moment that you're running a massive corporation. You've got clients, customers, suppliers, and employees spread across the globe. How do you ensure that payments flow seamlessly? How do you manage subscriptions, generate accurate invoices, and make sense of your financial data?

Enterprise billing is the answer to all these questions and more.

In a world where financial precision can make or break a business, enterprise billing is crucial. It's your pass to an efficient billing process, enhanced customer experiences, and scalable financial operations. Whether you're a financial guru or dipping your toes into the vast ocean of enterprise billing, understanding its importance is your key to unlocking the door to financial success.

This blog is your guide, your companion, and your go-to resource for mastering the art of enterprise billing.

Understanding Enterprise Billing

Enterprise billing is at the core of managing financial transactions for large businesses. In this section, we'll dive into the fundamentals of enterprise billing, exploring what it is, its key components, and how it differs from traditional billing and enterprise invoicing.

The Basics of Enterprise Billing

What is Enterprise Billing?

At its essence, enterprise billing refers to the comprehensive system and processes that organizations implement to manage their billing and payment needs on a large scale. It's not just about sending out invoices; it encompasses a complex set of operations that ensure accurate, timely, and efficient financial transactions within a company.

Key Components of Enterprise Billing

To grasp the concept fully, let's dissect the essential components of enterprise billing:

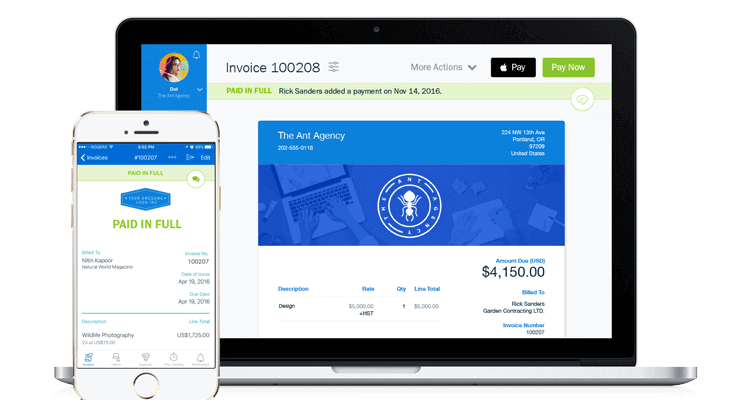

- Billing System: This is the heart of enterprise billing. It's the software or platform that automates billing processes, generates invoices, and keeps track of payment histories.

- Payment Gateway: An integral part of the system, this facilitates secure online payments, enabling customers to settle invoices through various payment methods.

- Invoice Generation: Enterprise billing software automates invoice creation based on predefined rules and templates, saving time and reducing errors.

- Subscription Management: Especially crucial for subscription-based businesses, this component handles recurring billing and ensures subscriptions are managed efficiently.

- Reporting and Analytics: Enterprise billing systems provide detailed insights into financial data, allowing businesses to make informed decisions.

- Integration Capabilities: Seamless integration with other business systems like CRM, ERP, and accounting software ensures a unified and streamlined process.

Enterprise Billing vs. Traditional Billing

Now that we have a grasp of what enterprise billing entails let's contrast it with traditional billing methods that smaller businesses often employ.

Traditional billing is typically manual and involves sending out paper invoices, recording payments by hand, and relying on spreadsheets or basic accounting software. While suitable for small enterprises, it lacks the automation, scalability, and precision that enterprise billing systems offer.

Enterprise billing stands out for its:

- Automation: It significantly reduces manual labor, automating repetitive tasks like invoice generation and payment processing.

- Scalability: Enterprise billing systems can handle a large volume of transactions, making them ideal for companies with high growth potential.

- Precision: With predefined rules and templates, errors in billing and invoicing are minimized, ensuring accurate financial records.

Enterprise Billing vs. Enterprise Invoicing

It's important to distinguish enterprise billing from enterprise invoicing, as these terms are sometimes used interchangeably.

Enterprise invoicing primarily focuses on the creation and delivery of invoices to customers. It's a subset of enterprise billing, which encompasses the broader scope of managing the entire billing and payment process. While enterprise invoicing is crucial for revenue generation, enterprise billing encompasses a more extensive range of functions, including payment processing, subscription management, and financial analysis.

In the next sections, we'll delve deeper into the benefits of using enterprise billing software, explore its key features, and help you choose the right solution for your business needs.

4 Benefits of Using Enterprise Billing Software

When it comes to managing the financial intricacies of a large enterprise, having the right tools can make all the difference. Enterprise billing software is one such tool, and in this section, we'll explore four key benefits it brings to the table.

1 – Streamlining Billing Processes

Streamlining your billing processes is paramount for the efficient operation of any enterprise. With enterprise billing software, this becomes a reality. Imagine a system that automatically generates invoices, sends them to clients, and even processes payments seamlessly. It's like having an efficient billing department working tirelessly, around the clock.

But it's not just about saving time; it's about minimizing errors. Manual billing processes often result in costly mistakes. Enterprise billing software, on the other hand, adheres to predefined rules and templates, reducing the risk of inaccuracies in your invoices. No more chasing down discrepancies or dealing with frustrated clients due to billing errors.

2 – Improved Accuracy and Efficiency

Improved accuracy and efficiency go hand in hand with enterprise billing software. Automation eliminates the need for manual data entry, reducing the chances of human error. Every invoice generated is consistent and error-free, reflecting positively on your professionalism and reliability.

Efficiency comes into play as tasks that once consumed significant hours of your team's time become effortless. Your employees can redirect their efforts toward more strategic, value-added activities, ultimately driving growth and innovation within your organization.

3 – Enhanced Customer Experience

In today's competitive business landscape, enhancing the customer experience is non-negotiable. Enterprise billing software contributes to this by providing your clients with a smoother and more convenient payment process.

Consider this scenario: A customer receives a well-structured, easy-to-understand digital invoice and can make payments securely online with just a few clicks. No more deciphering handwritten invoices or navigating complex payment procedures. This enhanced experience leads to greater customer satisfaction, potentially fostering long-term relationships and repeat business.

4 – Scalability for Growing Businesses

As your business grows, so do your billing needs. This is where the scalability of enterprise billing software truly shines. Whether you're adding more clients, expanding your product or service offerings, or entering new markets, your billing system should seamlessly adapt to these changes.

Enterprise billing software is designed to handle large volumes of transactions and can be customized to accommodate the unique needs of your growing enterprise. It grows with you, eliminating the need to constantly overhaul your billing infrastructure as your business expands.

In summary, enterprise billing software offers a compelling array of benefits, from simplifying billing processes and boosting accuracy to enhancing the customer experience and providing scalability.

Choosing the Right Enterprise Billing Software

Selecting the ideal enterprise billing software for your organization is a crucial decision that can significantly impact your financial operations. In this section, we'll discuss the key factors you should consider when making this important choice.

Business Size and Needs

The first step in choosing the right enterprise billing software is evaluating your business size and specific needs. Consider the volume of transactions you handle and the complexity of your billing requirements. Are you a small or mid-sized enterprise, or do you belong to the realm of large corporations?

Understanding your unique needs is vital. For instance, if you run a subscription-based business, you'll require software that excels in subscription management. On the other hand, if you operate in multiple regions, international billing capabilities become essential. Tailoring your choice to your business size and needs ensures you invest in a solution that aligns perfectly with your objectives.

Budget Constraints

Budget constraints are a reality for most businesses. Evaluating your budget for implementing enterprise billing software is crucial. While it's tempting to go for the most feature-rich option, it's equally important to strike a balance between functionality and cost-effectiveness.

Consider not only the initial setup costs but also ongoing maintenance, support, and licensing fees. Calculate the return on investment (ROI) you expect from the software and ensure it aligns with your budgetary constraints. Remember, the goal is to optimize your billing processes without overextending your financial resources.

Integration with Existing Systems

Integrating your new enterprise billing software with your existing systems is a critical consideration. Compatibility and seamless integration with other key business systems, such as CRM, ERP, and accounting software, can significantly impact your efficiency.

Ask yourself how well the software can work alongside your current infrastructure. Does it offer APIs and connectors that allow for easy data exchange? A well-integrated system ensures that your billing data flows seamlessly between departments, eliminating data silos and streamlining operations.

Choosing the right enterprise billing software requires a thorough analysis of your business size and needs, careful budget considerations, and a keen focus on integration capabilities.

Top Enterprise Billing Software Solutions

Let's take a closer look at three leading enterprise billing software solutions:

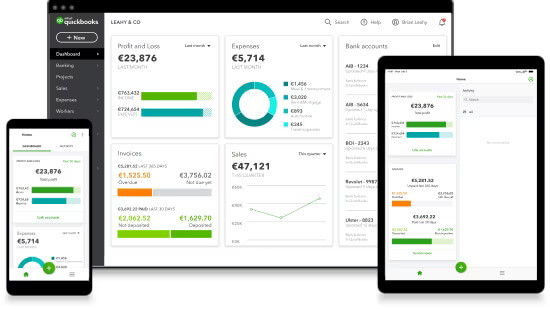

QuickBooks Online

Features and Benefits

QuickBooks Online is a versatile and widely trusted accounting and billing software. It offers a comprehensive suite of features tailored to both small businesses and larger enterprises. Some key features and benefits include:

- Invoice Generation: Create professional invoices with ease, customize templates, and automate recurring billing.

- Expense Tracking: Efficiently track and manage expenses, ensuring accurate financial records.

- Integration: Seamlessly integrate with other business tools, such as CRM and accounting software.

- Financial Reporting: Generate detailed financial reports for insights into your organization's financial health.

Pricing

QuickBooks Online offers an initial 30-day free trial before you start paying for the product. From there, they have four public pricing plans which range from $30 a month through to $200 a month depending on your company’s requirements.

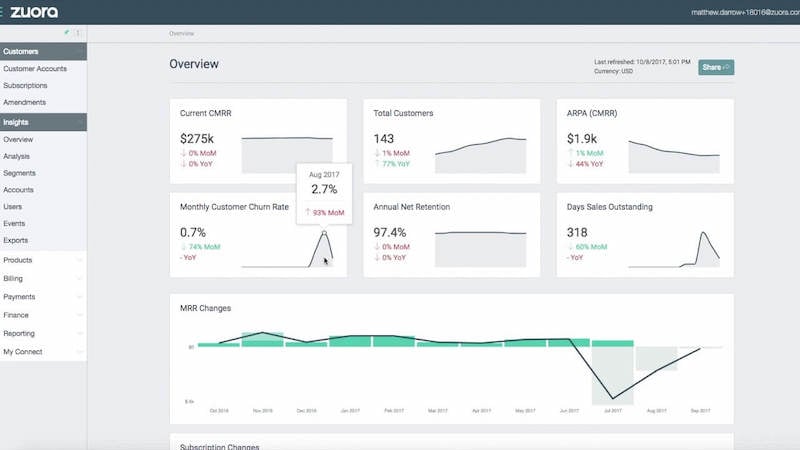

Zuora Billing

Features and Benefits

Zuora Billing is designed specifically for subscription-based businesses, offering a robust platform for managing billing, subscriptions, and revenue recognition. Key features and benefits include:

- Subscription Management: Easily manage subscriptions, billing cycles, and pricing changes.

- Revenue Recognition: Automate revenue recognition processes, ensuring compliance with accounting standards.

- Analytics and Insights: Gain valuable insights into subscriber behavior and financial performance.

- Integration: Integrate with CRM, ERP, and other systems to streamline operations.

Pricing

Zuora offer an impressive range of products and features, but don’t state any of their pricing publicly. To find out the costs you need to contact Zuora directly.

Freshbooks

Features and Benefits

Freshbooks is a user-friendly accounting and billing software known for its simplicity and effectiveness. It offers features that make billing a breeze for small to medium-sized enterprises. Key features and benefits include:

- Invoice Customization: Easily create and personalize invoices to match your brand.

- Time Tracking: Track billable hours and expenses, making it ideal for service-based businesses.

- Client Portal: Provide clients with a convenient portal to view and pay invoices.

- Expense Management: Streamline expense tracking and management.

Pricing

Freshbooks offers three publicly stated pricing plans, ranging from $17 a month to $55 a month, before a higher-level plan which is negotiated with their sales folks.

Implementing Enterprise Billing

Implementing enterprise billing software is a significant undertaking that requires careful planning and execution. In this section, we'll guide you through the implementation process, including planning and preparation, integration with existing systems, employee training, and how to overcome common challenges.

The Implementation Process

Planning and Preparation

Planning and preparation are the cornerstones of a successful enterprise billing software implementation. Before diving into the process, create a comprehensive plan that outlines your objectives, timelines, and responsibilities.

Identify key stakeholders who will be involved in the implementation and establish clear communication channels.

Consider the following steps during this phase:

- Needs Assessment: Review your current billing processes and identify areas that need improvement. Define your goals for implementing the software.

- Selecting the Right Team: Appoint a project manager and assemble a dedicated team responsible for the implementation.

- Setting a Realistic Timeline: Determine a realistic timeline for the implementation, taking into account potential challenges and dependencies.

Integration with Existing Systems

Integration with your existing systems is a critical aspect of implementation. Ensure that your enterprise billing software seamlessly connects with your CRM, ERP, and accounting systems.

This integration will enable the smooth flow of data and minimize disruptions to your operations.

During this phase:

- Consult with IT Experts: Engage your IT team or consultants to assess the compatibility of the software with your existing infrastructure.

- Test Integration: Conduct thorough integration testing to identify and address any issues before going live.

Employee Training

The success of your enterprise billing software implementation depends on adequate employee training. Even the most sophisticated software is only as effective as the individuals using it.

Plan training sessions to familiarize your staff with the new system, ensuring they can use it confidently.

Consider these best practices:

- Customized Training: Tailor training sessions to different user groups within your organization, ensuring each team understands how to use the software in their specific roles.

- Ongoing Support: Provide ongoing support and resources for employees as they adapt to the new system. Encourage questions and feedback to address any concerns promptly.

Common Challenges and How to Overcome Them

Implementing enterprise billing software can pose challenges, but with the right approach, you can overcome them. Here are some common challenges and strategies to address them:

- Resistance to Change: Employees may resist transitioning to a new system. To overcome this, communicate the benefits, offer comprehensive training, and involve staff in the decision-making process.

- Data Migration Issues: Transferring existing data to the new system can be complex. Ensure you have a well-defined data migration plan and conduct thorough testing to avoid data loss or corruption.

- Integration Problems: Integration issues can arise. Regularly communicate with your software provider and IT team to address any integration challenges promptly.

- Scope Creep: Stay focused on your initial goals to prevent scope creep. Changes and additions to the project should be carefully evaluated to avoid delays and budget overruns.

Introducing enterprise billing software into an existing process requires meticulous planning, smooth integration, thorough employee training, and a proactive approach to addressing challenges. When executed effectively, the transition to a new billing system can streamline your operations and contribute to your organization's success.

Best Practices for Enterprise Billing

Effectively managing enterprise billing is more than just implementing the right software; it's about adhering to best practices that ensure smooth operations and customer satisfaction. In this section, we'll explore four key best practices for enterprise billing: ensuring data security, billing transparency, regular auditing and reconciliation, and effective customer communication.

Ensuring Data Security

Data security should be a top priority in enterprise billing. You are entrusted with sensitive financial information, both your own and your customers'. To maintain trust and compliance with regulations, consider these measures:

- Encryption: Utilize strong encryption protocols to protect data during transmission and storage.

- Access Control: Limit access to billing data to authorized personnel only, and implement robust access control mechanisms.

- Regular Security Audits: Conduct routine security audits and vulnerability assessments to identify and address potential threats.

By ensuring data security, you not only protect your organization but also build trust with your customers.

Billing Transparency

Billing transparency is essential for building strong customer relationships. Customers appreciate clarity in their invoices and transactions. Here's how you can achieve it:

- Clear Invoices: Ensure that your invoices are easy to understand, with itemized charges and a breakdown of fees.

- Transparent Pricing: Communicate your pricing clearly and avoid hidden charges.

- Timely Communication: Keep customers informed about upcoming payments, changes in billing terms, and any issues that may affect their invoices.

Transparency builds trust and reduces customer disputes, leading to a more positive customer experience.

Regular Auditing and Reconciliation

Regular auditing and reconciliation are crucial for maintaining financial accuracy. This practice involves comparing your financial records against external sources, such as bank statements or payment processors, to identify discrepancies. Here's how to implement it effectively:

- Scheduled Audits: Establish a regular schedule for auditing and reconciliation, ensuring that it aligns with your billing cycles.

- Automated Tools: Utilize billing software with built-in auditing features to streamline the process.

- Resolution of Discrepancies: Promptly address any discrepancies found during auditing to maintain financial accuracy.

By regularly auditing and reconciling your billing records, you can identify and rectify errors before they become major issues.

Customer Communication

Effective customer communication is often underestimated in billing processes. Clear and timely communication can prevent misunderstandings and foster positive relationships. Consider these practices:

- Proactive Updates: Inform customers about upcoming payments, changes in billing methods, or any disruptions in service well in advance.

- Responsive Support: Provide accessible customer support channels for billing inquiries and issues.

- Feedback Collection: Seek feedback from customers regarding their billing experience and use it to make improvements.

By keeping the lines of communication open and responsive, you enhance the overall customer experience and reduce billing-related frustrations.

Adhering to best practices in enterprise billing ensures not only the efficient operation of your financial processes but also the satisfaction of your customers.

Data security, billing transparency, regular auditing, and effective customer communication are essential components of a well-rounded billing strategy.

FAQs about Enterprise Billing

As we conclude our comprehensive guide on enterprise billing, you may have some lingering questions. In this section, we'll address common queries to provide you with a complete understanding of this critical aspect of financial management.

Does a company need an enterprise billing department?

The necessity for an enterprise billing department depends on the size and complexity of your organization's billing needs. Small businesses may manage with a lean billing team, while large enterprises often require dedicated billing departments or teams.

A well-structured billing department ensures efficient billing processes, accurate record-keeping, and timely payment collections. It also allows for specialized roles, such as billing analysts and collections specialists, to handle various aspects of billing.

Ultimately, whether your organization needs a dedicated billing department or not hinges on your specific requirements, the volume of transactions, and your commitment to streamlined financial operations.

What is the average cost of an enterprise billing software?

The average cost of enterprise billing software can vary widely depending on several factors, including the software's features, scalability, and the number of users. On average, you can expect to pay anywhere from a few hundred dollars per month to several thousand dollars annually for a comprehensive enterprise billing solution.

It's crucial to consider your organization's size, needs, and budget when evaluating software options. Some software providers offer tiered pricing plans, allowing you to choose the package that aligns best with your requirements.

Remember that while the cost is a significant factor, the value and ROI the software delivers should also be a key consideration in your decision-making process.

.png?width=1024&height=749&name=cpi%20illustration%20(1).png)

What are some common enterprise billing issues to look out for?

While enterprise billing software can greatly streamline your financial processes, it's essential to be aware of common issues that may arise:

- Billing Errors: Even with automation, billing errors can occur, leading to customer disputes and revenue loss. Regular audits and quality checks can help mitigate this issue.

- Data Security Concerns: Safeguarding sensitive financial data is paramount. Ensure your software and processes comply with data security regulations to prevent breaches.

- Integration Challenges: Integrating billing software with existing systems can be complex. Thoroughly test and plan your integration to avoid disruptions.

- Customer Communication: Inadequate communication with customers regarding billing changes or issues can lead to dissatisfaction. Maintain open channels for customer inquiries and concerns.

Being proactive in addressing these issues and continuously monitoring your billing processes will help you maintain a robust and efficient billing system.

Key Takeaways for Enterprise Billing

In today's rapidly evolving business landscape, enterprise billing plays a pivotal role in achieving financial efficiency and maintaining competitiveness.

It's not just a matter of sending out invoices; it's about orchestrating a seamless and secure financial flow that supports your organization's growth and customer satisfaction.

As you navigate the complexities of enterprise billing, remember that choosing the right software, implementing best practices, and staying attuned to the needs of your organization and customers are keys to success. Stay proactive, embrace innovation, and continuously seek ways to optimize your billing processes.

With the knowledge gained from this guide, you are well-equipped to embark on the journey of effective enterprise billing, ensuring the financial health and sustainability of your organization in the modern business landscape.

Share this

You May Also Like

These Related Stories

Introduction to the Importance of B2B Enterprise SaaS Platforms

Cost Centers in the Microsoft CSP Commerce World: Part 2: Cost Centers Are Now a CSP Billing and Reporting