Before You Step Back from Direct CSP: What You Really Give Away

Microsoft’s 2025 CSP changes have turned a long-running question into an urgent one for many MSPs. Stay a Direct Bill partner and invest to meet the new bar, or fall back to an indirect model under a distributor.

On the surface, the choice looks pragmatic. Direct Bill partners will need at least 1 million dollars in trailing 12-month CSP revenue, an active Advanced or Premier Support plan, a Solutions Partner designation, and a Partner Center security score of 80 or higher, with annual capability assessments. Miss that bar, and you risk losing authorization.

Microsoft’s own guidance offers a safety valve. Partners that cannot meet the direct requirements can transition to an indirect reseller authorization and continue selling through a distributor instead.

Distributors are presenting this as a near-frictionless fix. They will handle billing, program changes, and much of the support for some small or stagnant CSP practices that may be the right answer.

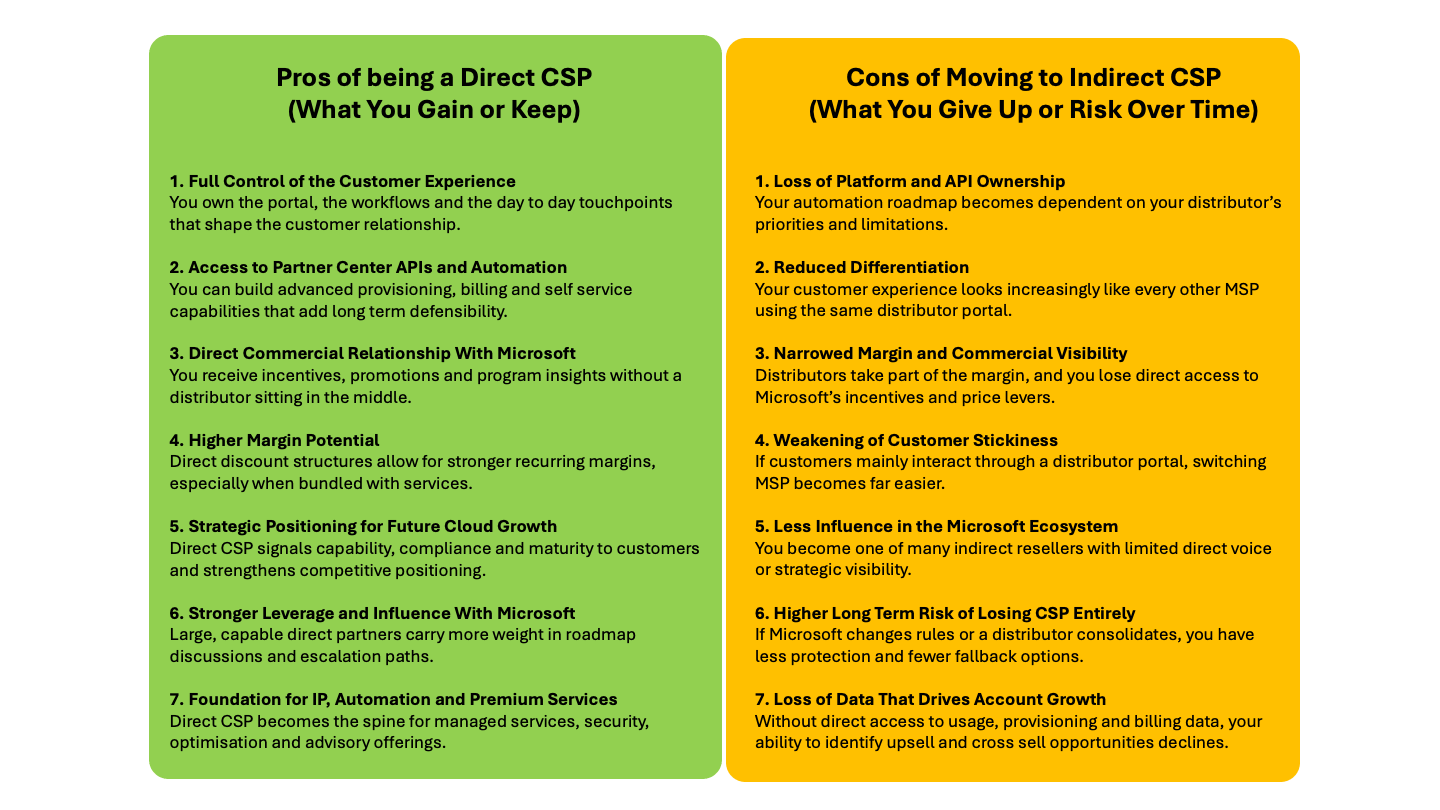

For growing MSPs, it is more complicated. Moving from direct to indirect is not a neutral operational choice. It permanently changes your control over automation, data, and customer experience in ways that only become obvious a few years later.

The technical trade you make on day one

The first change is hidden in Microsoft’s own Partner Center documentation. When you transition from Direct Bill to indirect reseller, and your direct tenant status is set to “restricted”, you lose access to the Partner Center sandbox and the API and SDK capabilities that are reserved for direct partners.

Those APIs are not an abstract feature. They are the backbone of serious CSP platforms, including automated provisioning, recurring billing engines, white-label customer portals, and tight integration with PSA and ERP tools. Cloudmore’s own guidance on transitioning from indirect to direct emphasizes that mature direct partners heavily rely on those APIs and automation to make CSPs scalable and profitable.

Give that up, and you are effectively agreeing that your distributor will set the pace for your automation roadmap. Your “portal” becomes their portal. Your ability to differentiate based on experience is bounded by their backlog.

Commercially, the margin stack also changes. In the indirect model, Microsoft bills the distributor, the distributor bills you, and you, in turn, bill the customer. MSPs discussing their numbers in the r/msp community typically describe margins in the low to mid-teens for indirect resellers, with the distributor retaining its own discount from Microsoft.

Again, that may still make sense financially. You avoid the direct cost of support contracts and internal billing teams. The price you pay is that a third party now sits between you and Microsoft’s incentives, promotions, and program levers.

Once you have lost Direct CSP status, you may never be able to regain it.

How the relationship tilts over time

The deeper risk is not visible in month one. It shows up over three to five years.

Direct CSP status forces a certain level of operational maturity. The new rules explicitly test sales capacity, solution capability, operations, support, compliance, and security, and they link that test to your right to transact.

Partners that build to that standard usually do so for a reason. They want CSP to be more than a licensing line. They use usage and billing data to drive managed services, security, advisory projects, and their own intellectual property. They build branded self-service portals so that customers come to them when they need to make changes.

If you step back to indirect without building your own platform and processes, several things happen.

- Your customer’s day-to-day experience moves away from you.

If license management and billing now live on a distributor portal, that portal becomes the operational “home” for Microsoft services. A competing MSP using the same distributor can, in effect, swap in their logo and undercut you on price.

- You have less room to differentiate.

Commentators analysing the CSP changes point out that partners who only resell licenses are likely to struggle. In an indirect model where the catalog, offers, and some of the support experience are standardized by the distributor, you risk being just another reseller on the same rails.

- Your influence with Microsoft drops.

The direction of travel in the program is clear. Direct status is being reserved for partners with scale, capability, and a deeper role in customer outcomes. Once you exit that group, your feedback goes through your distributor and their priorities. You are still in the ecosystem, but your direct line to the vendor is weaker.

All of this is happening while the distribution layer itself is being squeezed. Indirect providers will need at least $30 million in trailing CSP revenue per authorized region. Analysts expect that to drive consolidation among mid-market distributors. That means the partner who runs your portal and sits between you and Microsoft may change, merge, or refocus on a timetable you do not control.

If you ever lose CSP, you may lose much more

The most uncomfortable scenario is the one many partners prefer not to think about.

If you stay direct but fail a future reassessment and do not or cannot transition to indirect, Microsoft’s published position is stark. You can be deauthorised as a CSP, offboarded, and your customers notified that you no longer hold CSP status and need to be replaced.

Once a customer receives that message, the risk is obvious. They are encouraged to find a new reseller at precisely the moment large MSPs and distributors are ready with tightly bundled offers that combine licensing, support, and security. The licensing move can evolve into a comprehensive account transition over the next renewal cycle.

Even if you choose to go indirect early to avoid that trigger, the same principle applies if you do not own your own self-service and customer service layer. When a customer associates their Microsoft estate mainly with a distributor’s portal and a standard support queue, changing providers becomes a procurement exercise rather than a relationship decision.

At that point, losing CSP does not just mean losing a margin stream; it also means losing a significant source of revenue. You lose the data you use to understand which customers are growing or shrinking. You lose the daily touchpoints that justify advisory fees. You lose the platform you need to attach your own services and IP.

A harder decision, made earlier

None of this is an argument for every partner to remain direct at any cost. For some, especially those far below the new thresholds, the numbers simply do not work, and the indirect path is a sensible alternative.

This is an argument for treating the decision as strategic, rather than administrative.

If you are a serious MSP that expects to grow, the choice is less “direct versus indirect” and more “who owns our platform and our customer experience”.

You can stay direct, invest in security, automation, and self-service, and use CSP as the spine of a wider services business. Alternatively, you can use an indirect provider for the billing rail while maintaining that your own portal, data, and processes remain the primary means by which customers consume Microsoft services.

What you cannot afford to do is drift into a model where someone else owns the portal, the APIs, the data, and the roadmap, leaving you to compete solely on price and personality.

In a few years, that will not just be a CSP problem. It will be a business problem.

END

Share this

You May Also Like

These Related Stories

Is Your Billing Wrong Despite Using a CSP Automation Platform?

Microsoft CSP Margin Benchmarks: How Do You Compare?